Free Report

The Restaurant Labor Playbook

Increase your bottom line with insights from over 500 restaurant pros. You’ll learn:

The true cost of employee turnover

The best ways to manage labor costs

Proven strategies to protect profits

Why restaurants are exceeding labor targets

Where you stack up against your restaurant peers

Scroll down to read the full report

The true cost of employee turnover is higher than you think

Our research reveals the cost of replacing restaurant staff varies significantly by position:

Front-of-house replacements average $1,056 per position, while back-of-house replacements cost $1,491—a 41% premium. That difference reflects the specialized training required in kitchen roles. Most concerning is the cost of replacing management at $2,611 per position, a staggering 147% more than front-of-house. Every manager you retain saves you the equivalent of replacing two to three servers or hosts.

A typical restaurant has 15-20 FOH staff, 8-10 BOH, and 3-5 managers. With 50% FOH turnover, you're replacing 7-10 servers and hosts every year. That's $7,400-$10,560+ in FOH replacement costs alone—not counting the hit to service quality while new staff get up to speed.

Alice Cheng

CEO & Founder of Culinary Agents

An anonymous restaurateur

Most restaurants aren't hitting their labor targets

Even though restaurants feel pretty confident about their calculations, most aren't meeting their labor goals.

"If you only hit your target 50 percent of the time, your target isn't right…"

Jim Taylor

Restaurant consultant

Only about a third (36%) of restaurants hit their labor cost targets, while 44% spend more than planned.

The industry has some clear patterns: About 40% of restaurants keep their labor costs between 20-25% of their revenue, and another 26% fall between 26-30%. This tells us that the industry's normal range is between 20-30%. Only about 15% of restaurants manage to keep labor costs under 20%, and the same percentage (about 15%) struggle with costs over 30%.

"If you only hit your target 50 percent of the time, your target's not right," explains restaurant consultant Jim Taylor. "So often we see restaurants that set their targets based on one of two things. Either their labor target is a byproduct of what they want their net profit to be and they've just worked backwards, or they've looked at it historically and said, 'well, we always did this, so we should stay the same.' The restaurants that go through the full process required to accurately set a responsible labor cost target hit their targets 75 or 80 percent of the time."

POS/software analytics dominates as the primary method for tracking labor costs (76%), often combined with historical data comparison. As labor costs increase, restaurants are less likely to meet their targets.

"Technology solutions have helped us stay close to our labor budget while saving management an incredible amount of time. So far, it has been accurate and correct and has helped with budgeting, forecasting, and scheduling."

An assistant manager in casual dining

Food inflation ousts labor as top concern

Food inflation now dominates restaurant concerns, with 52% ranking it as their primary challenge and 86% including it in their top three. Labor costs closely follow as the second most pressing issue, ranked first by 31% of operators and in the top three for 83% of restaurants. It's a switch from previous years, which saw labor as the top issue, and food inflation as the second.

The combined pressure of these rising costssqueezes already-thin profit margins. Interestingly, staff turnover appears to be one of the top three concerns for 36% of restaurants.

Food inflation

Labor costs

Rent/utilities

Staff turnover

“It's really hard getting a reasonable profit at the end of the month. Food and labor costs are so expensive at the moment because of inflation. Unfortunately, the extra cost has to be passed down to the consumer."

Most restaurants (around 68%) are now training their staff to handle multiple jobs instead of just firing people. They're creating teams that can switch between different tasks when needed. Other popular approaches include changing the number of staff hours they schedule (45%), making their processes work better (41%), and yes, some are still reducing their headcount (39%).

"I would rather pay a person 20 an hour that knows three stations and is a good salesperson than pay someone 15 an hour that knows one station and doesn't sell."

Jim Taylor

Restaurant consultant

This approach creates more versatile teams while potentially boosting revenue through better customer service.

Restaurants that spend a lot on labor are way more likely to cut staff. 7 out of 10 operators with labor costs over 40% say they cut staff, while only 14% of restaurants with average labor costs do the same. Places with lower labor costs tend to use a mix of different approaches instead of just relying on one strategy.

A general manager in fine dining notes, "When labor costs are supported by an advanced, more skilled labor force, I am not concerned."

Another casual dining Owner/Operator states, " A good schedule can manage labor costs."

Restaurants are focused on growth over cost-cutting

Even when costs are high, most restaurants are looking to grow their sales rather than just cutting back. Raising menu prices is the most popular move (63% are doing this), but they're not stopping there. They're also training staff to suggest more expensive items (45%), finding completely new ways to make money (37%), simplifying their menus (34%), or featuring items that make more profit (29%).

This shows restaurants are getting creative—not panicking and cutting corners.

Jim Taylor

Restaurant consultant

This price anchoring technique allows restaurants to maintain margins while managing customer price sensitivity.

Jordan Boesch

CEO of 7shifts

Back-office technologies have the highest adoption rates

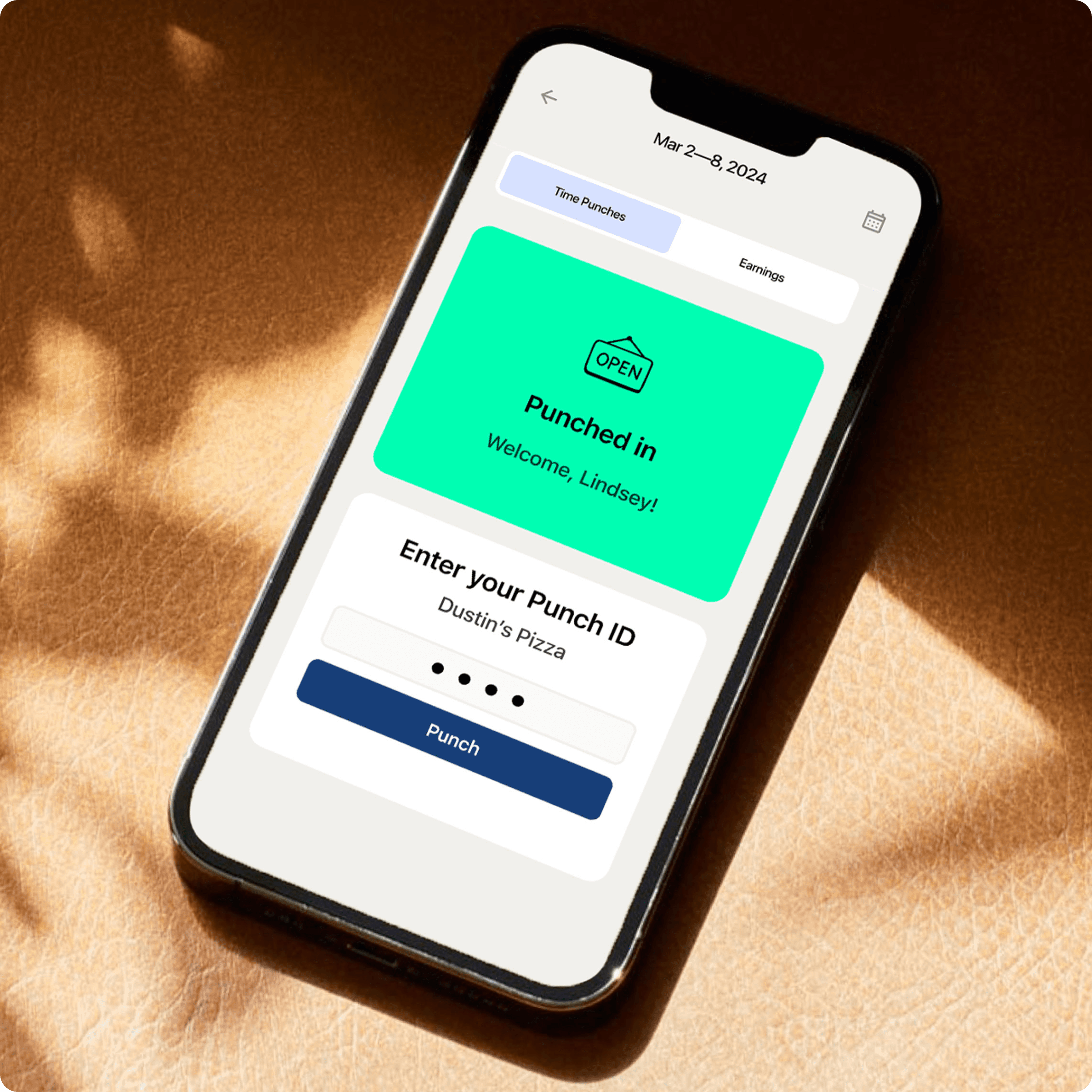

Back-office tech leads the way. Automated payroll (52%), staff scheduling (49%), and inventory management (51%) top the list. Bigger restaurants adopt faster—71% of restaurants with 51-100 employees use scheduling software versus 53% of smaller venues.

Customer-facing tech shows mixed results. QR ordering sits at 33% adoption, with 29% not interested. Self-service kiosks face the most pushback (47% uninterested) with just 19% adoption. While only 9% use AI answering systems now, 44% are planning or considering it—a potential shift in the making.

Restaurant Technology Adoption Landscape

Already implemented

Planning or considering

Not interested

Back-Office Technologies

Automated payroll

Inventory Management software

Staff scheduling software

Customer-Facing Technologies

QR code ordering

Order & pay at table devices

Self-service kiosks

Emerging Technologies

AI-powered phone systems

Kitchen automation/

robotics

Automated inventory ordering

About half of all restaurants (49%) express optimism about technology's role in reducing labor costs, with 21% very optimistic and 28% somewhat optimistic. Only 16% report pessimism, while 34% remain neutral. This positive outlook comes despite implementation challenges and concerns about preserving the human element of hospitality.

Restaurants resist customer-facing tech the most. Why? They worry about losing that personal touch their guests love. As one general manager told us: "Customers want the experience. I don't believe AI can give that to them."

But let's face it – tech is here. As competition heats up and solutions get better, restaurants will keep adopting new tools, both for customers and behind the scenes.

Restaurant Operator Optimism: Technology Reducing Labor Costs

Optimistic

Somewhat optimistic

Neutral

Somewhat pessimistic

Very pessimistic

Navigating the future of restaurant profitability

The restaurant industry stands at a pivotal crossroads in 2025. Our research reveals significant challenges and promising opportunities for operators who adapt strategically. Food inflation and labor costs continue to squeeze margins from both sides. However, successful restaurants respond by going all-in on growth, not with across-the-board cuts.

Cross-training is the solution on the labor front, allowing restaurants to build more versatile teams while keeping costs down. When you combine that with strategic menu engineering and technology adoption, you controlspending while growing your bottom line.

The data points to a clear conclusion: restaurants that thrive in this environment don’t just focus on cutting costs. They are proactive about managing their staff, leveraging team development and technology to create sustainable business models.

About this report

Our 2025 Restaurant Labor Cost & Profitability Survey collected responses from 511 restaurant professionals across casual dining (53%), quick service/fast casual (33%), and fine dining (10%) establishments. Using stratified random sampling, we surveyed decision-makers including general managers (40%), assistant managers (35%), and owner/operators (18%) representing diverse restaurant sizes: 1-10 employees (19%), 11-25 employees (36%), 26-50 employees (22%), 51-100 employees (20%), and 100+ employees (4%). The survey was conducted in partnership with Centiment from February 18-24, 2025.

Report by D.J. Costantino

Graphics by Cassie Cassell